About the VSLA App

Role

Product Manager, UX Researcher & Designer

Tools & Methods

Team

Project Lead, Development Team (Ghana & Tanzania)

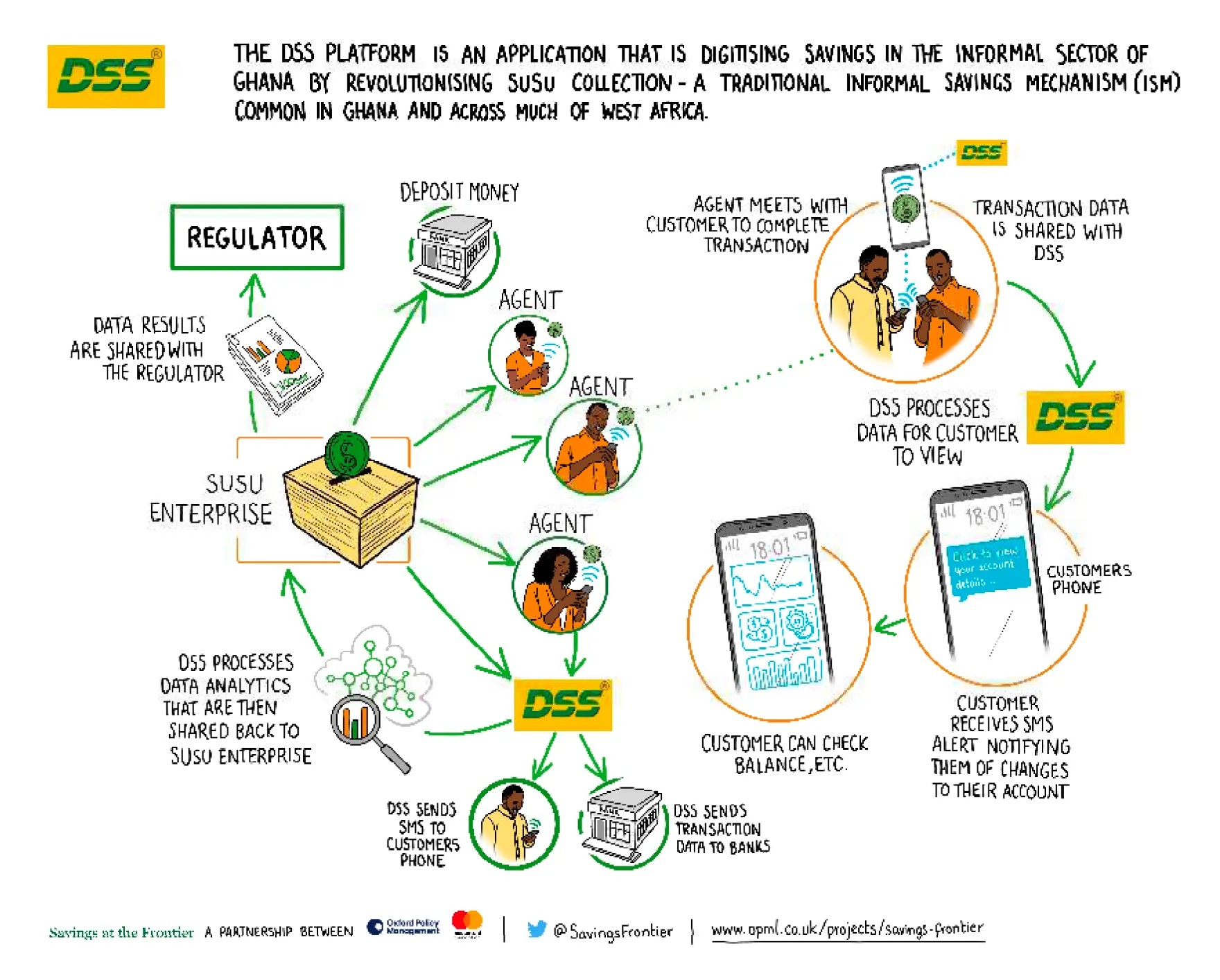

Under the Savings at the Frontier (SATF) project—a partnership between the Mastercard Foundation and Oxford Policy Management (OPM)—DSS was tasked with digitising traditional savings processes in low-income communities across sub-Saharan Africa. Their goal was to transform informal savings practices into a scalable, technology-driven platform, enabling greater access to formal financial services. The DSS platform is a bottom-up digital solution that modernises Ghana's informal savings system. By leveraging technology, it streamlines how savings are mobilised within communities, bridging the gap between traditional savings groups and the formal financial sector. This innovative approach empowers underserved populations by making saving safer, more transparent, and accessible. I served as the product manager, researcher, and designer, collaborating closely with the project lead and development team in Ghana and Tanzania. Additionally, I took on the role of photographer during field trips.

Background

Despite growth in Ghana's financial sector since 2010, access to financial services remains uneven, especially in rural areas. Between 2011 and 2017, rural financial access nearly doubled, yet the poor continued to lag behind the non-poor (World Bank, 2019). In 2011, one in five women who could have accessed formal financial services lacked access due to the gender gap. Mobile money and digital financial services have significantly improved inclusion. Historically underserved, Ghanaian farmers now enjoy financial access equal to the national average. The poor, while still the most excluded, have seen access rise from two-thirds to nine-tenths of the average. Youth have also made significant gains, indicating that digital services are effectively narrowing financial access gaps across marginalised groups.

Challenge

DSS offered a financial solution primarily used by small-scale financial organisations in some cities in Ghana. This subscription-based product served established, registered organizations that could afford its services. While the platform supported medium- to low-income communities, it did not directly address the unique challenges faced by farmers and rural groups relying on manual, traditional savings systems. These communities struggled with issues such as fund reconciliation, record-keeping, and the risk of lost funds—all consequences of managing savings manually. Without a digital system, they faced significant operational inefficiencies and financial vulnerabilities, highlighting the need for a more tailored and accessible financial solution.

Solution

My initial task was to identify the challenges faced by farmers and rural communities. To do this, I worked closely with the team to visit various farming communities, observe their farms, and participate in several meetings. This hands-on approach helped me understand their fund collection process, assess their needs, and uncover key pain points. To address these challenges, we developed a digital platform that transformed the traditional manual savings process into an accessible, user-friendly financial system. The solution preserved culturally significant aspects of the savings process while introducing modern features to improve efficiency and security.

A leader of a Susu Group leading a session on the traditional susu collection process.

Some members of a VSLA group in the Volta Region of Ghana.

Key Features

- Digital Fund Management: Automating fund collection, reconciliation, and record-keeping to reduce human error and prevent loss of funds.

- Cultural Integration: Recognising the importance of rituals, such as prayer during savings meetings, the platform included culturally relevant prompts to maintain trust and familiarity.

- Data Migration: Providing seamless migration of historical financial records from old passbooks to the digital system, ensuring continuity and transparency.

By bridging the gap between tradition and technology, the DSS platform empowered rural communities with secure, transparent, and efficient financial services while respecting their unique cultural practices.

Design Process

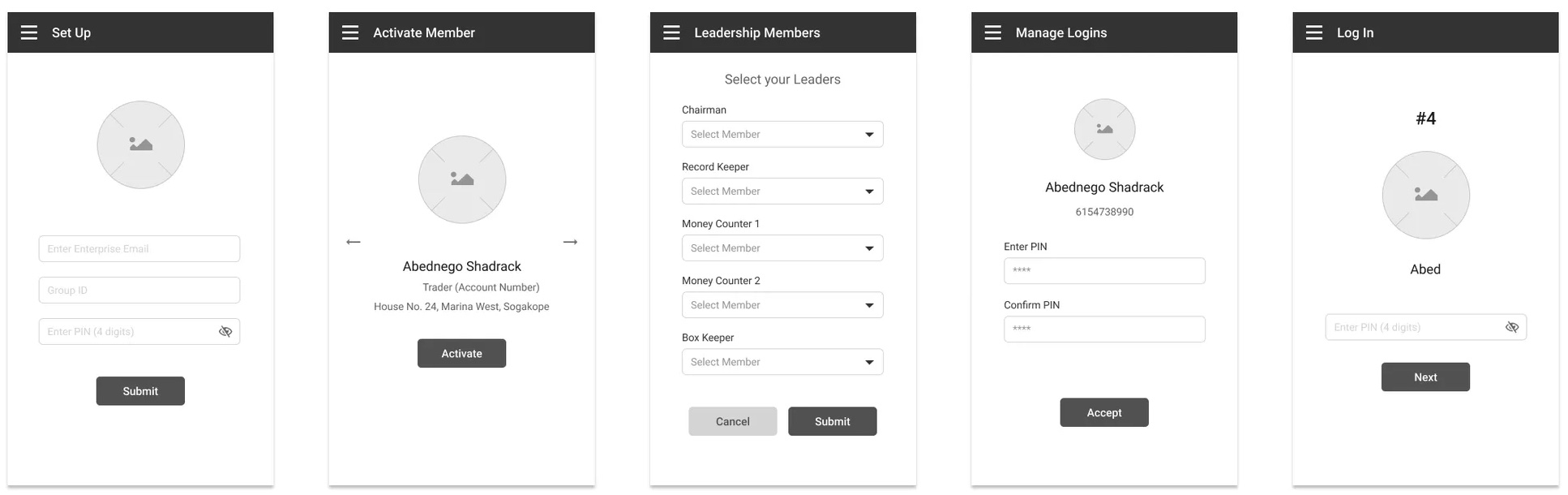

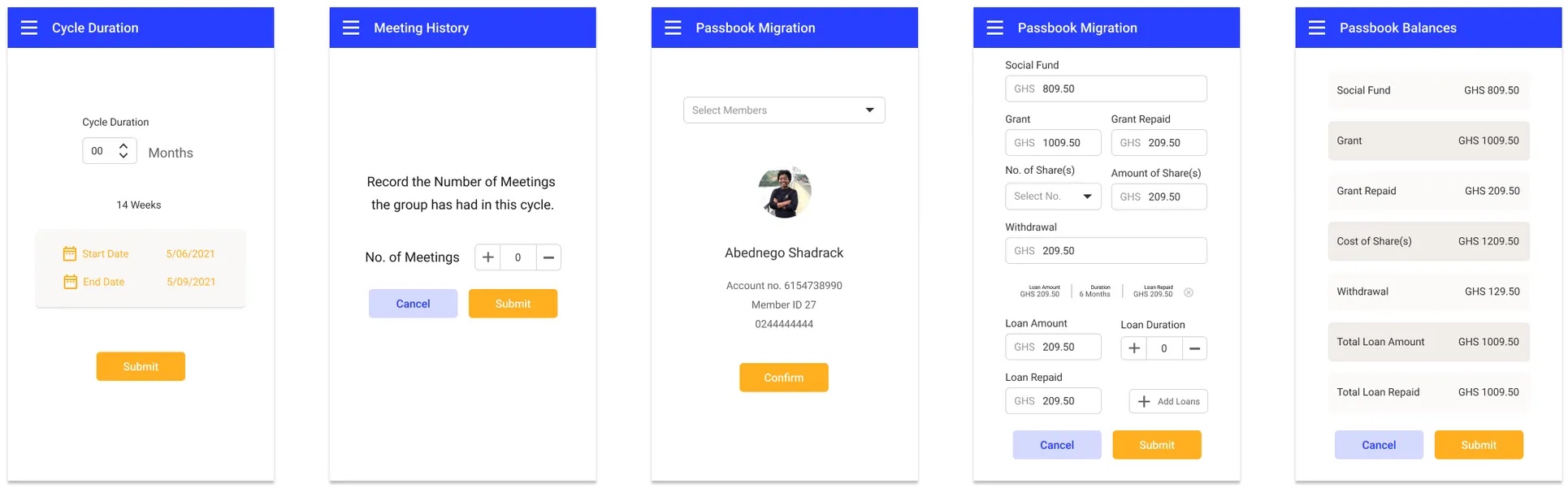

Mid Fidelity Designs

Sign Up and Log in process for the VSLA app.

Process for migrating user information from old Passbook to the app.

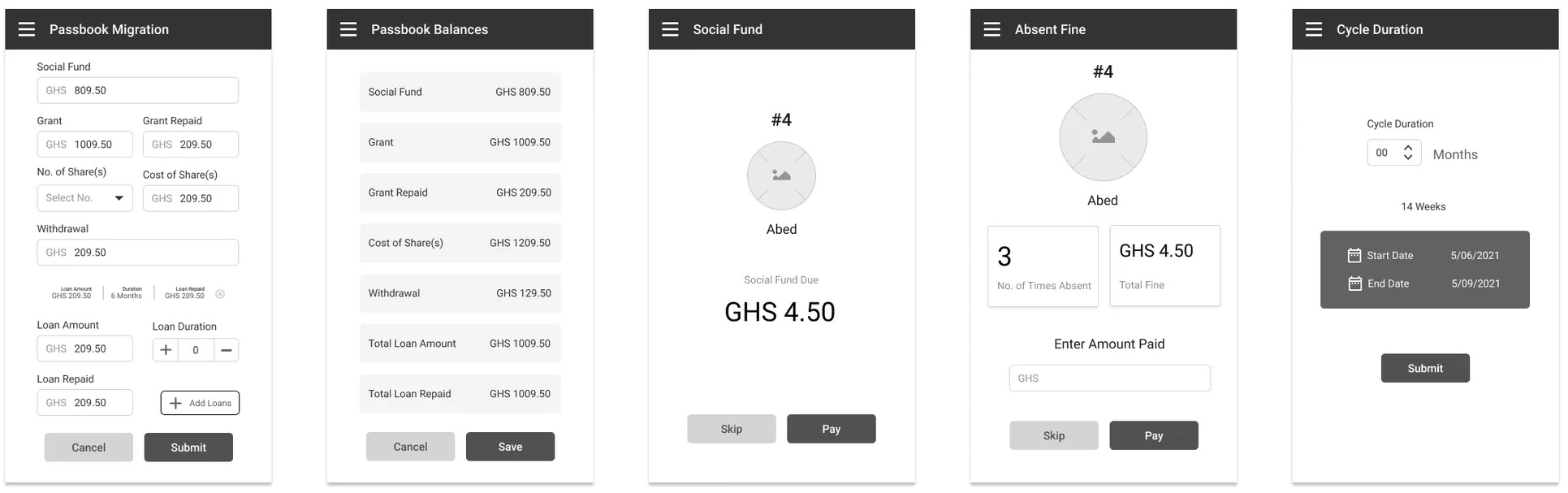

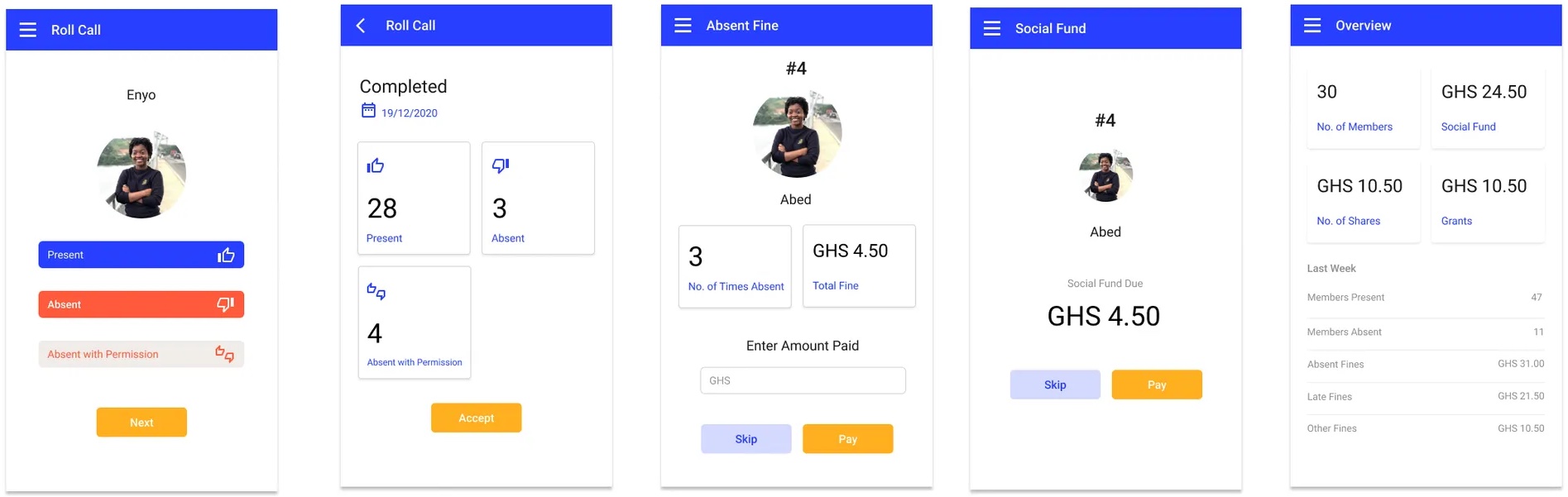

High Fidelity Designs

Flow for Passbook Migration.

Flow for Meeting Process.