miWay Insurance

The aim of the project was to conduct research to identify and validate the root causes of premium collection issues. Our main goal was to design an optimized premium collection service and a self-service payment system that addressed customers' main pain points. The existing product experienced a rising drop-off rate and consumed about 15% of call center time due to frequent customer complaints. To address this, we collaborated closely with call center supervisors, managers, and members of the CXLaunchpad—an initiative by LeapFrog focused on building customer experience capabilities within companies. This collaborative approach allowed us to co-create effective solutions that streamlined the payment process and improved customer satisfaction.

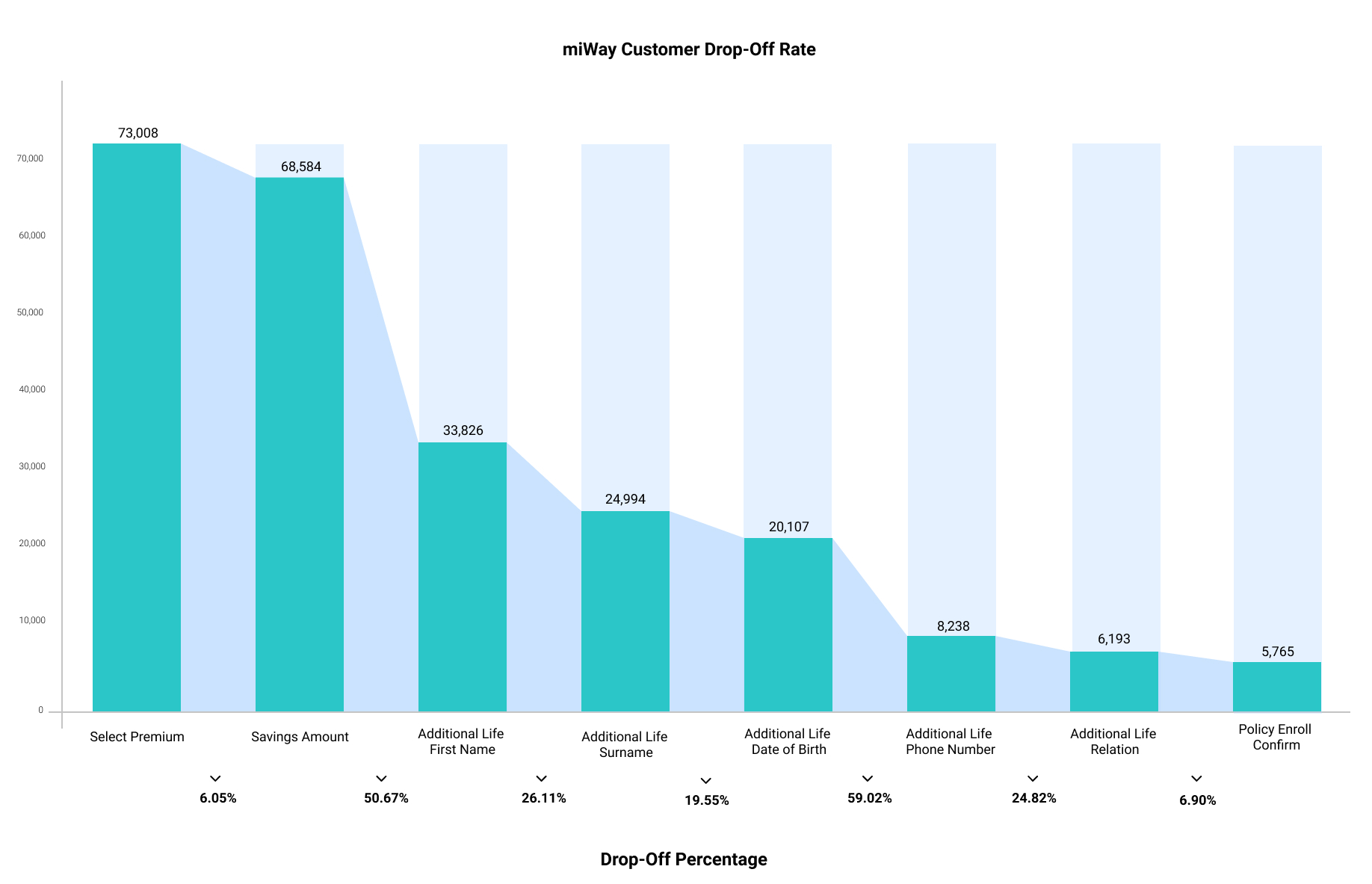

Problem During Onboarding

Over 50% of potential customers drop after reaching the Optional Savings screen on USSD. A further 59% drop upon reaching the Selected Family Member Date of Birth screen.

Pain Points Identified after Subscription

- The insufficient number of collection runs - Runs are manually triggered and managed two (2) times in the month.

- Some customers are not included in the monthly runs even though their mobile money wallet is sufficiently funded. Only 30% of billing is successful during the first collection run.

- Some customers missing collection runs altogether due to late deposit of funds in their wallets.

- Collection runs are not scheduled at times when the success rate is likely to be at its maximum since optimum times are currently unknown.

Concept Testing Based on Pain Points

Allow customers to select their own billing date.

Allow customers to pay for multiple months in advance and potentially get a discount as a result.

Use IVR to trigger an arrears payment (instead of manually by Call Center agent).

Send customers who have missed a payment a link via SMS to execute a one-time payment.

The Design Process

1. Interviews

Interviews were conducted with 8 call center supervisors and agents to understand what they perceived the problem with the premium collection was. A survey was also created and data was collected in the form of an interview with 112 random customers to observe their mobile money usage habits and their understanding of the collection runs.

2. Usability Audit

An auditing and testing round with current and new users was conducted to ascertain usability issues with the existing product. Data on incomplete sign-ups was also collected from the system's backend.

Challenges Faced By Users Per Screen

2.1 Savings Amount Screen

Users misunderstood the screen as a separate monthly payment instead of additional savings to their premium.

Adding Savings to their premium amount appeared out of context since the product introduced to them was that of insurance.

Users were unsure of how to reply in order to move to the next step.

Users were skeptical since the Savings amount did not come with interest.

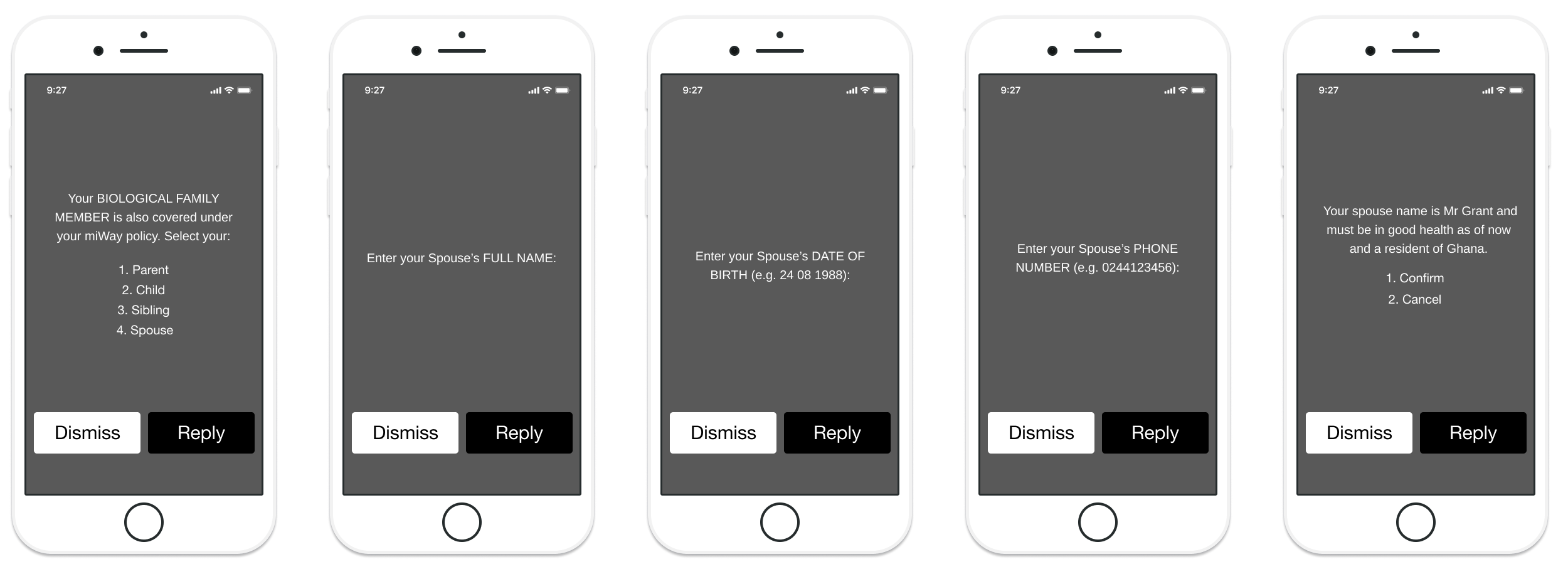

2.2 Additional Life Screens

Users misunderstood who an additional life was and why they needed to strictly be a biological family member.

User were unsure of 'who' to add as the additional life or their details such as 'date of birth' and 'contact details'.

Users did not understand the policy and why they needed to add one.

2.3 Other Reasons

Started sign-up process due to curiosity.

Long sign-up process than it should be in their opinion.

Solution

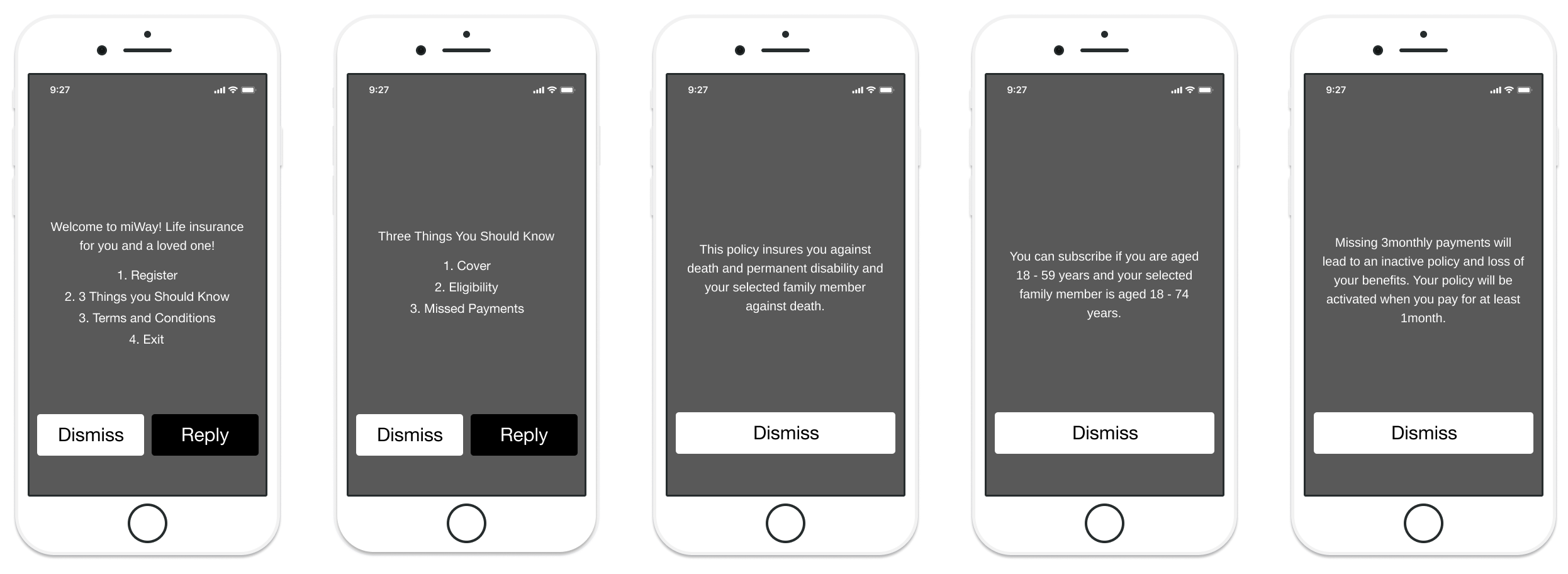

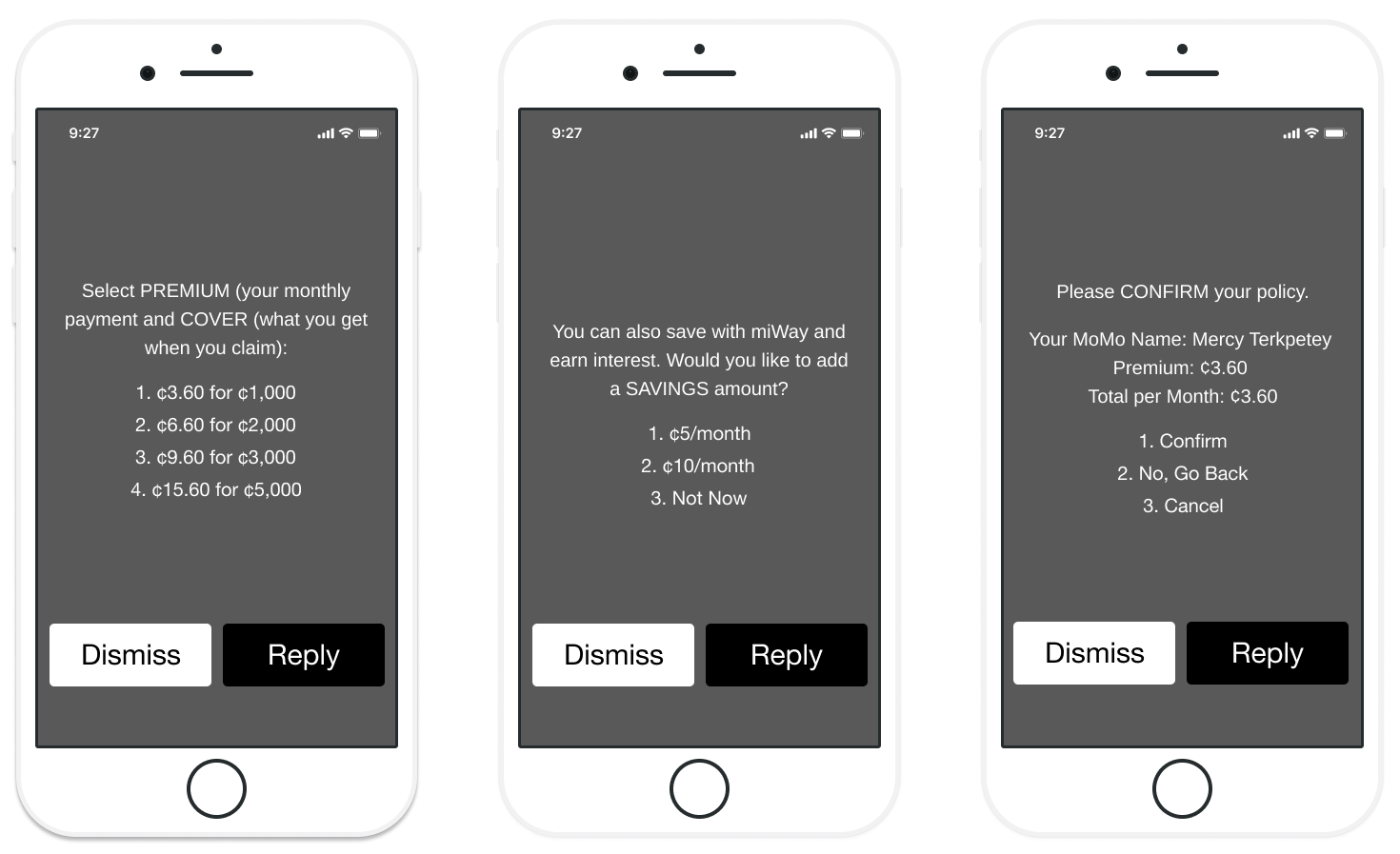

Solutions for New Users

Deferment of Savings Option and Additional Life Steps to make the process sign-up process less cumbersome. An SMS would be sent two (2) working days after sign-up to remind subscribers to fill in the details for the deferred screens.

'3 Thing you Should Know' option on the onboarding screen to explain the product to users any time they visit the platform through USSD code (#165).

An option to totally 'skip' the Savings Option step during the sign-up process.

Changes in the verbiage used across screens to make the wording SIMPLE and easily understandable.

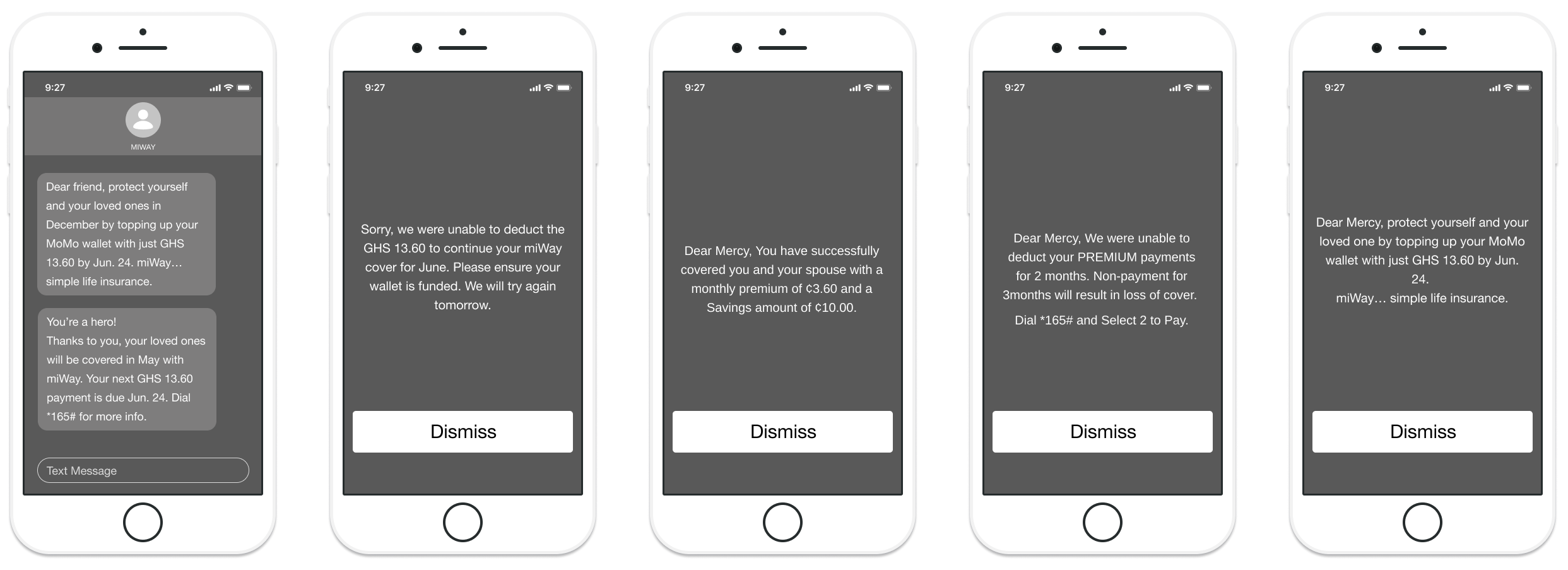

Solutions for Existing Users

Send Customers who missed their payment a link via SMS to execute a one-time payment.

Collection run should be triggered automatically not manually.

Collection run should be triggered from the 24th of the month through to the 1st of the following month instead of the current collection run on the 20th of each month.

Concept Testing Feedback based on Survey

Allow customers to select their own billing date.

Allow customers to pay for multiple months in advance and potentially get a discount as a result.

Use IVR to trigger an arrears payment (instead of manually by Call Center agent).

Send customers who have missed a payment a link via SMS to execute a one-time payment.

Iteration and Testing

Final Testing and Feedback

A final testing conducted with some users showed that users had a better understanding of what the product is about and requested for further features.

"The process is understandable, there is no need to defer the screens."

"The wording is very understandable and easy to follow."

"I do not want to add a savings amount, I want to concentrate on the insurance policy."

"There should be more options for biological family member, what about my adopted kids? What if I don't have any biological family member?"